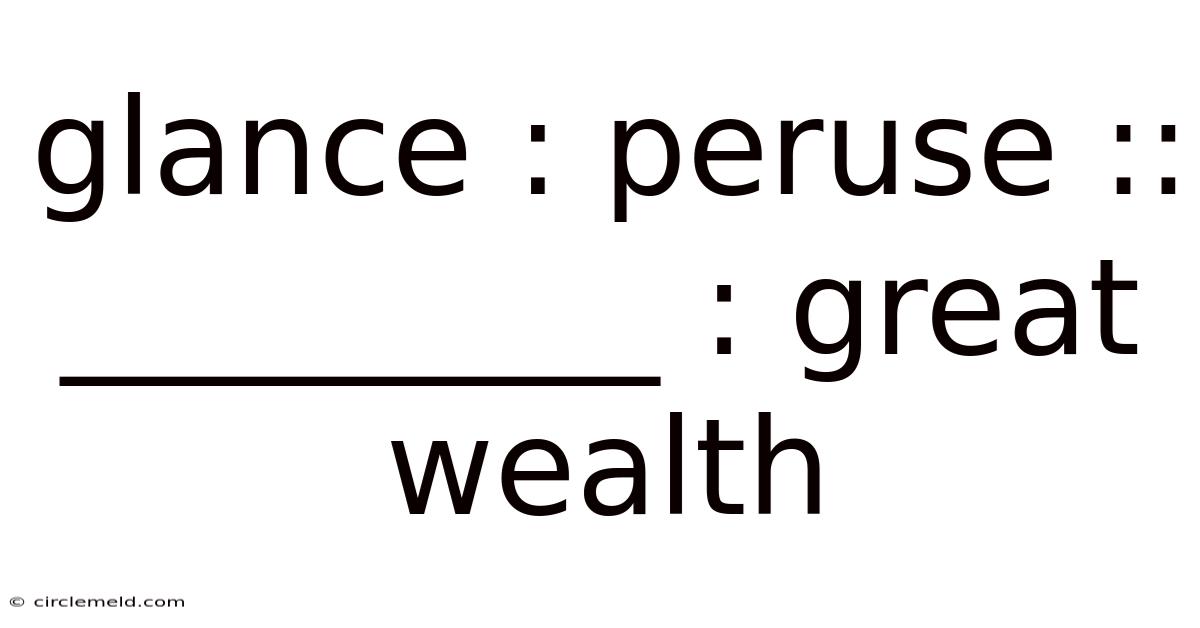

Glance : Peruse :: _________ : Great Wealth

circlemeld.com

Sep 16, 2025 · 6 min read

Table of Contents

Glance : Peruse :: Squander : Great Wealth

The analogy "glance : peruse :: _________ : great wealth" presents a relationship between actions and their corresponding outcomes, specifically focusing on the contrasting approaches to consuming information versus managing resources. The core relationship lies in the difference between a brief, superficial interaction and a thorough, deliberate engagement. Therefore, the missing word should reflect an action that contrasts with careful stewardship of wealth, just as "peruse" contrasts with "glance." The best fit is squander. Let's explore this analogy in detail, examining the relationship between the words and expanding on the concept of financial responsibility.

Understanding the Analogy: Opposites Attract

The analogy establishes a clear parallel:

- Glance: A quick, fleeting look; a superficial examination.

- Peruse: To read or examine something carefully and thoroughly.

- Squander: To waste (something, especially money or time) in a reckless and irresponsible way.

- Great Wealth: A significant accumulation of riches or resources.

The relationship is one of opposites or contrasting actions. "Glance" represents a superficial interaction, while "peruse" denotes a deep engagement. Similarly, "squander" represents the irresponsible mismanagement of wealth, the opposite of careful stewardship or wise investment which would be necessary to maintain "great wealth." A person who squanders their great wealth is actively working against maintaining it.

Exploring the Concept of Squandering Wealth

Squandering wealth goes beyond simply spending money. It involves a reckless disregard for the value of resources, often resulting in significant financial losses. Several factors can contribute to this behavior:

- Impulsivity: Making rash decisions without considering the long-term consequences. Buying expensive items on a whim, without regard for budgeting or financial planning, is a classic example.

- Lack of Financial Literacy: A limited understanding of personal finance, budgeting, investing, and debt management. Without this knowledge, individuals are more likely to make poor financial choices.

- Addiction: Gambling addiction, substance abuse, or shopping addiction can lead to uncontrolled spending and depletion of resources.

- Entitlement: A sense of privilege or unearned deservingness can fuel extravagant spending habits, without a consideration for the future.

- Poor Planning: Failure to create and stick to a budget, leading to overspending and accumulating debt.

The consequences of squandering wealth can be devastating:

- Financial Ruin: Losing significant amounts of money, possibly leading to bankruptcy or extreme financial hardship.

- Loss of Opportunities: Missed investment opportunities, inability to pursue education or career advancements due to lack of funds.

- Relationship Strain: Financial disagreements and stress can damage personal relationships.

- Mental Health Issues: Financial anxieties and the stress of debt can significantly impact mental wellbeing.

- Loss of Reputation: Public knowledge of reckless spending can damage personal reputation and credibility.

The Importance of Financial Prudence

The opposite of squandering is prudent financial management. This involves a conscious effort to make responsible decisions about money, aiming for long-term financial security. Key elements of financial prudence include:

- Budgeting: Creating and adhering to a realistic budget that tracks income and expenses, allowing for savings and debt repayment.

- Saving and Investing: Setting aside a portion of income regularly for future needs, such as retirement, emergencies, or major purchases. Investing wisely can help wealth grow over time.

- Debt Management: Minimizing debt and strategically managing existing debt to avoid high interest charges.

- Financial Education: Continuously learning about personal finance, investing, and risk management.

- Seeking Professional Advice: Consulting with financial advisors to receive personalized guidance and create a comprehensive financial plan.

- Goal Setting: Defining clear financial goals, such as buying a home, funding education, or securing retirement, and developing plans to achieve them.

Analogies and Their Application

The power of analogies lies in their ability to illustrate complex concepts in a simple and memorable way. The analogy "glance : peruse :: squander : great wealth" highlights the importance of a careful and deliberate approach to managing valuable resources. Just as a thorough examination is necessary to understand a complex text, careful planning and responsible spending are essential to managing and growing wealth. A superficial approach, like a quick glance, can lead to missed opportunities and ultimately, the squandering of potentially valuable resources. This applies not just to financial resources, but to time, relationships, and other valuable assets in life.

Expanding the Analogy: Further Examples

To further solidify the understanding of this analogy, let's consider additional examples that demonstrate similar relationships:

-

Sip : Guzzle :: Save : Squander: This analogy directly links the controlled consumption of a beverage (sip) with the careful management of resources (save), contrasting them with the uncontrolled consumption (guzzle) and reckless mismanagement (squander).

-

Sample : Devour :: Budget : Overspend: This emphasizes the difference between a cautious approach (sampling) and careful financial planning (budgeting) versus an uncontrolled indulgence (devouring) and irresponsible spending (overspending).

-

Sketch : Masterpiece :: Gamble : Invest: This analogy highlights the contrast between a quick, preliminary effort (sketch) and a well-planned, high-quality work (masterpiece), mirroring the contrast between risky, speculative behavior (gambling) and strategic, long-term planning (investing).

Beyond Finance: Applying the Principle

The principle of careful consideration versus impulsive action extends far beyond financial management. It applies to various aspects of life:

-

Relationships: A quick glance at a person's character may lead to misjudgment, whereas a thorough understanding of their personality through extended interaction fosters deeper, more meaningful relationships.

-

Education: A cursory review of study material will likely result in poor academic performance, while dedicated, thorough study leads to greater understanding and success.

-

Career Development: A superficial approach to career planning can result in missed opportunities, whereas careful planning and goal-setting can lead to career advancement.

-

Health: Ignoring health issues (a "glance") can lead to severe consequences, whereas regular check-ups and mindful lifestyle choices (a "perusal") promote wellbeing.

Frequently Asked Questions (FAQs)

Q: What are some common signs of squandering wealth?

A: Common signs include impulsive purchases, inability to track expenses, consistent reliance on credit cards, ignoring financial advice, neglecting savings, and facing financial hardship despite high income.

Q: How can I avoid squandering my wealth?

A: Create a detailed budget, track expenses, set financial goals, learn about personal finance, seek professional guidance if needed, and avoid impulsive spending.

Q: What is the difference between spending and squandering?

A: Spending involves using money for necessary or desired items. Squandering involves reckless and irresponsible spending that leads to significant financial loss and hardship. It's the lack of planning and control that distinguishes squandering from ordinary spending.

Q: Can someone recover from squandering their wealth?

A: Yes, recovery is possible through financial counseling, creating a strict budget, addressing any underlying issues contributing to the behavior, and commitment to long-term financial responsibility.

Conclusion

The analogy "glance : peruse :: squander : great wealth" effectively encapsulates the crucial difference between superficial engagement and thorough consideration, particularly in the context of managing valuable resources. Squandering wealth represents a stark contrast to responsible financial management. By understanding this analogy and applying the principles of financial prudence, individuals can avoid the pitfalls of irresponsible spending and work towards achieving lasting financial security and wellbeing. Remember, just as thorough perusal leads to deeper understanding, careful planning and deliberate action are essential for maintaining and growing great wealth, not just in monetary terms, but in all aspects of life.

Latest Posts

Latest Posts

-

Juanita No Pudo Ir A La Fiesta Si No

Sep 16, 2025

-

What Are The Powers Of The President

Sep 16, 2025

-

An Index Of Suspicion Is Most Accurately Defined As

Sep 16, 2025

-

Large Vehicles Have Difficulty Changing Lanes Due To

Sep 16, 2025

-

Essentials Of Radiographic Physics And Imaging Chapter 2

Sep 16, 2025

Related Post

Thank you for visiting our website which covers about Glance : Peruse :: _________ : Great Wealth . We hope the information provided has been useful to you. Feel free to contact us if you have any questions or need further assistance. See you next time and don't miss to bookmark.